The Importance of QuickBooks Training for Accountants

QuickBooks has become the most popular accounting program in the world. Its comprehensive suite of features—from bookkeeping and payroll to inventory and tax management—supports millions of businesses and professionals in handling financial operations efficiently. However, proper training can only unlock the software’s full potential. QuickBooks training for accountants is essential to boost productivity, accuracy, and compliance. It equips professionals with in-depth knowledge, allowing them to handle complex financial tasks easily. Furthermore, earning a QuickBooks certification can open doors to better career opportunities and demonstrate high competence to clients and employers.

Start your journey with our complete QuickBooks training program tailored for professionals at all levels.

What is QuickBooks?

QuickBooks is a powerful accounting software developed by Intuit. It is designed for small—to medium-sized businesses and professional accountants. It helps users manage income, track expenses, send invoices, process payroll, and prepare for taxes.

Learn more from our guide on What is QuickBooks and How Does It Work.

Who is QuickBooks for?

QuickBooks is ideal for:

- Freelancers and solopreneurs

- Small business owners

- Bookkeepers and accountants

- Industry professionals such as real estate agents and e-commerce sellers (QuickBooks for eCommerce Businesses, QuickBooks for Real Estate Agents)

QuickBooks Online vs. Desktop

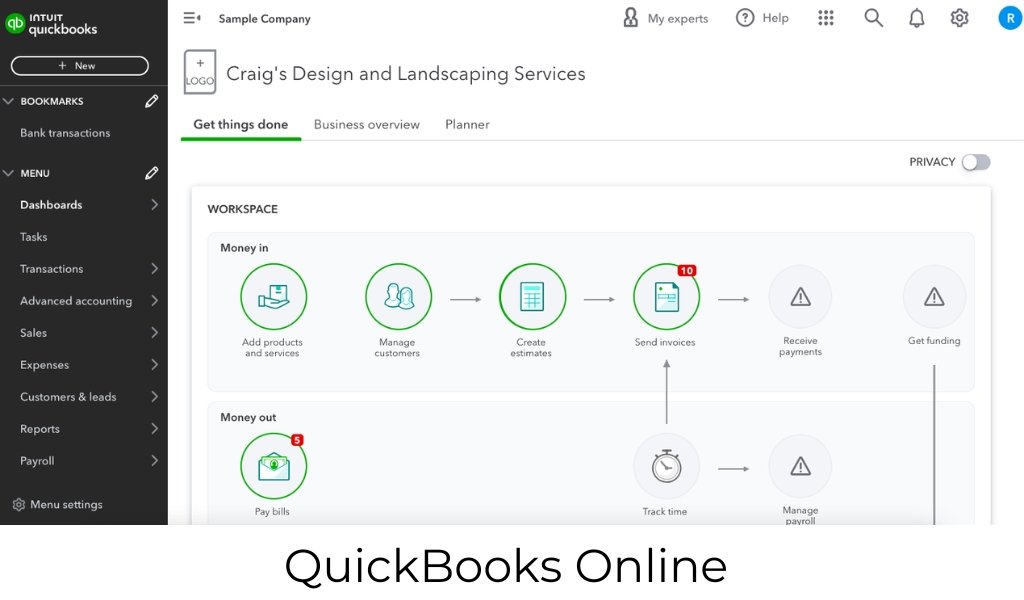

Understanding the differences between QuickBooks Online and QuickBooks Desktop is crucial for selecting the right platform:

- QuickBooks Online: Cloud-based, accessible anywhere, integrates with apps, and is best for collaborative work.

- QuickBooks Desktop: Installed locally, has more powerful features like job costing and is ideal for larger or more complex businesses.

Role in Bookkeeping and Financial Management

QuickBooks streamlines bookkeeping by automating routine tasks like categorizing expenses, reconciling bank statements, and generating reports. It improves financial management by offering real-time dashboards, forecasts, and comprehensive financial statements.

Are you new to bookkeeping? Start with our beginner guide: How to Use QuickBooks for Small Business Accounting or 7 Simple Steps to Manage Small Business Accounting.

Explore more features and tutorials in our QuickBooks Online Training.

Benefits of QuickBooks Training for Accountants

QuickBooks training offers numerous advantages that go beyond basic usage. Here are the core benefits for accountants:

1. Master Advanced Features

Through structured training, accountants can master powerful tools like:

- Custom financial reports (Learn to create financial statements like a pro)

- Payroll processing

- Tax calculation

- Invoicing and inventory tracking

2. Improve Accuracy and Reduce Manual Errors

Training helps users understand how to correctly input data, automate transactions, and reconcile accounts—minimizing errors that can lead to audits or financial discrepancies. Avoid common mistakes with expert guidance.

3. Boost Client Trust with Certified Expertise

Becoming QuickBooks certified builds credibility and signals to clients that you’re a trusted professional. Check our 2-Day QuickBooks Class to prepare for certification in just two days.

4. Increase Efficiency Through Automation

QuickBooks automates time-consuming tasks like recurring invoices, payroll, and expense tracking. Trained users know how to configure and customize these tools for maximum productivity. Compare plans side-by-side to choose the best automation features for your needs.

5. Stand Out in the Job Market

Employers increasingly prefer candidates with proven software skills. Training in QuickBooks improves your resume and gives you confidence in interviews and freelance opportunities.

Explore advanced QuickBooks tips, accountant tools, and certification options to elevate your skills beyond the basics.

QuickBooks Training for Accountants: How to Handle ‘Changes Pending’ Status

Keywords: QuickBooks accountant changes pending, QuickBooks updates, user permissions, accountant tools

QuickBooks is known for its intuitive design and powerful features streamlining bookkeeping and accounting tasks. Among these tools, one standout feature for collaboration between business owners and their accountants is “Accountant Changes Pending.” Whether you’re a small business owner or a professional accountant, understanding how this feature works can save time, improve communication, and ensure that changes are tracked and approved accurately.

What Is “Accountant Changes Pending” in QuickBooks?

“Accountant Changes Pending” is a status notification in QuickBooks Desktop when an accountant has changed a company file using the Accountant’s Copy. This feature signals to the business owner or primary user that:

- The accountant has made changes.

- Those changes are pending approval or incorporation into the live file.

- The file is temporarily restricted from certain modifications to protect data integrity.

🔄 It is essentially a bridge between the accountant’s work and the client’s final file, ensuring all modifications are controlled and approved before merging.

How the “Accountant’s Copy” System Works

To fully understand the “Accountant Changes Pending” notice, it’s essential to know how the Accountant’s Copy system functions:

- Business Owner Creates an Accountant’s Copy

- A specific version of the QuickBooks file is created and sent to the accountant with a dividing date. This allows both parties to work on their respective data sections without interfering with each other’s work.

- Accountant Makes Changes

- Using QuickBooks Accountant Edition, the accountant performs adjustments, such as journal entries, reconciliation, chart of account edits, and more.

- Sending Back the Changes

- Once done, the accountant generates a . QBY file (Accountant’s Changes file) and sends it back to the client.

- Importing Changes

- When the business owner or bookkeeper imports this file, QuickBooks sets the status to “Accountant Changes Pending.”

Why the “Accountant Changes Pending” Notification Matters

This notification is more than just a reminder—it performs essential functions that impact how you manage your file:

✅ Data Integrity

QuickBooks locks down transactions before the dividing date to prevent accidental changes that may contradict the accountant’s work.

✅ Approval Workflow

It ensures that the client or file administrator reviews and approves the accountant’s changes before going live.

✅ Audit Trail

This system allows both parties to maintain a clear audit trail, making detecting issues easier and reversing changes if necessary.

Tips to Manage and Communicate Changes Effectively

Managing the “Accountant Changes Pending” status efficiently involves some best practices for both business owners and accounting professionals:

1. Set Clear Deadlines and Communication

Inform your accountant about key dates, such as tax filing deadlines or monthly closes. Always clarify when you need the file returned to avoid overlapping work.

2. Limit File Edits During Pending Status

Avoid editing transactions dated before the dividing date while the status is active. This protects against data conflicts.

3. Review Changes Carefully

QuickBooks allows you to preview all proposed changes. Ensure you or your team review the list of modifications before importing them.

4. Use the Comment Feature

Accountants can include notes or comments with their changes. Please encourage them to use these to clarify complex journal entries or reversals.

5. Back Up Your File

Always create a backup of your company file before importing it.QBY file. If anything goes wrong, you can restore your original data.

6. Use QuickBooks Accountant Tools

If you’re an accountant, make sure you’re using the QuickBooks Accountant Edition. This edition includes batch entry tools, reclassification features, and advanced QuickBooks tips to improve collaboration.

When You See “Accountant Changes Pending,” Here’s What To Do:

- Do not delete or rename your company file.

- Avoid running reconciliations or making changes before the dividing date.

- Communicate with your accountant to confirm the changes have been completed and shared correctly.

- Once the changes are imported, QuickBooks will automatically update and remove the pending status.

The Importance of QuickBooks Training for New Entrepreneurs

QuickBooks isn’t just for seasoned accountants—it’s a vital tool for new entrepreneurs who want to understand, manage, and grow their businesses efficiently. Whether launching a startup or running a small business, having a clear picture of your finances is crucial. With QuickBooks training for entrepreneurs, you can build the skills to manage your books confidently and avoid costly financial errors.

Efficient Financial Management

One of the biggest challenges for new business owners is tracking money flow. QuickBooks makes this easy:

- Track income, expenses, and profits in real time through user-friendly dashboards.

- Monitor cash flow, manage receivables and payables, and get alerts on late payments.

New users can start by understanding how QuickBooks works and then dive deeper into using QuickBooks for small business accounting.

Time and Resource Optimization

Entrepreneurs wear many hats. QuickBooks saves time with the following:

- Automated invoicing, bank reconciliation, and expense tracking

- Built-in templates for quotes, bills, and financial reports

This allows you to focus on growing your business instead of getting buried in spreadsheets. Learn how to simplify your books in just 7 simple steps.

Informed Decision-Making

With real-time data, you can make smart business decisions:

- Generate custom financial reports that reflect sales, expenses, and profitability

- Use visual dashboards and analytics to plan future strategies

Explore how to generate financial statements in QuickBooks like a pro.

Compliance and Accuracy

From tax deadlines to audits, compliance can be overwhelming. QuickBooks makes it easier by:

- Automatically tracking expenses

- Categorizing tax-relevant entries for you

- Reducing manual errors during filing

Use QuickBooks Online Training to stay updated on updates and best practices.

Streamlined Collaboration

You don’t have to do it all alone. QuickBooks allows for:

- Shared access with accountants, bookkeepers, and partners

- Real-time updates that everyone can see, improving communication

With training, you’ll know how to manage user roles and securely collaborate using tools covered in QuickBooks plans comparison.

Cost-Effective Solution

QuickBooks offers a range of features at an affordable price:

- Budget-friendly subscriptions tailored to small business needs

- Avoid costly accounting errors that could derail your cash flow

Check out our detailed guide on QuickBooks packages and pricing to choose the best fit for your business.

Adaptability to Growth

Your business may be small today, but with the right tools, it can scale fast. QuickBooks grows with you:

- Add features like inventory, payroll, CRM, or e-commerce integration

- Choose from advanced options, including QuickBooks for e-commerce businesses or advanced QuickBooks tips for scaling

Trust the Professionals at the Harding Group

While QuickBooks Training for Accountants gives you independence, partnering with professionals ensures you’re on the right path. At the Harding Group (or your firm), we guide entrepreneurs through setup, training, and long-term support. You can start your journey by enrolling in a 2-day QuickBooks class or completing a training program. Ongoing post-training support is also available.

Conclusion

Whether you’re a startup founder or an established business owner, investing in QuickBooks training for accountants is a strategic move toward financial control and business success. It improves accuracy, boosts decision-making, and empowers you to focus on what truly matters: growth.

Take the first step now—learn QuickBooks from experts and gain the confidence to manage your finances like a pro.

FAQs: about QuickBooks Training for Accountants

A: The Complete QuickBooks Training Program is ideal for beginners and professionals looking to master the software.

A: With intensive options like our 2-day QuickBooks class, you can start on weekends.

A: Absolutely. It enhances your credibility and increases your marketability and efficiency in managing business finances.

A: Yes, but only after the dividing date. Pre-dividing date changes are restricted to avoid conflicts.

A: QuickBooks gives you the option to accept or reject changes. If you reject them, your company file remains unchanged.

A: The status will only be removed once you import the accountant’s changes successfully.