Why QuickBooks Is Essential for the Construction and Contracting Industry

Introduction to QuickBooks in Construction

QuickBooks has revolutionized financial management for various industries, and construction is no exception. It provides powerful tools to simplify accounting tasks, save time, and reduce errors. Learn more about QuickBooks Online Training.

Quick Overview of QuickBooks

QuickBooks is an accounting software that helps businesses handle financial data, such as tracking expenses, creating invoices, and generating financial statements. It has different versions suited for various industries, including construction.

The Relevance of QuickBooks in Construction and Contracting

QuickBooks helps contractors manage complex project budgets, track materials, and ensure timely invoicing in the construction industry. It’s an essential tool for managing cash flow and ensuring financial compliance. For detailed insights on using QuickBooks for small business accounting, check out How to Use QuickBooks for Small Business Accounting.

Challenges Faced by the Construction Industry

Managing Project Budgets and Cash Flow

Construction companies often face challenges with budget overruns and delayed payments. QuickBooks helps manage budgets by tracking project costs in real time, providing an accurate view of cash flow.

Tracking Labor, Material, and Overhead Costs

Labor, materials, and overhead are the main components of construction costs. QuickBooks allows contractors to track these expenses accurately and integrate them into project costs. Learn more about Advanced QuickBooks Tips.

Compliance, Tax, and Payroll Issues

The construction industry has strict regulatory requirements, challenging payroll and tax compliance. QuickBooks helps streamline payroll management, ensuring taxes are calculated correctly. QuickBooks offers contractors a seamless way to comply with local tax regulations. Check out QuickBooks Plans Comparison for suitable options.

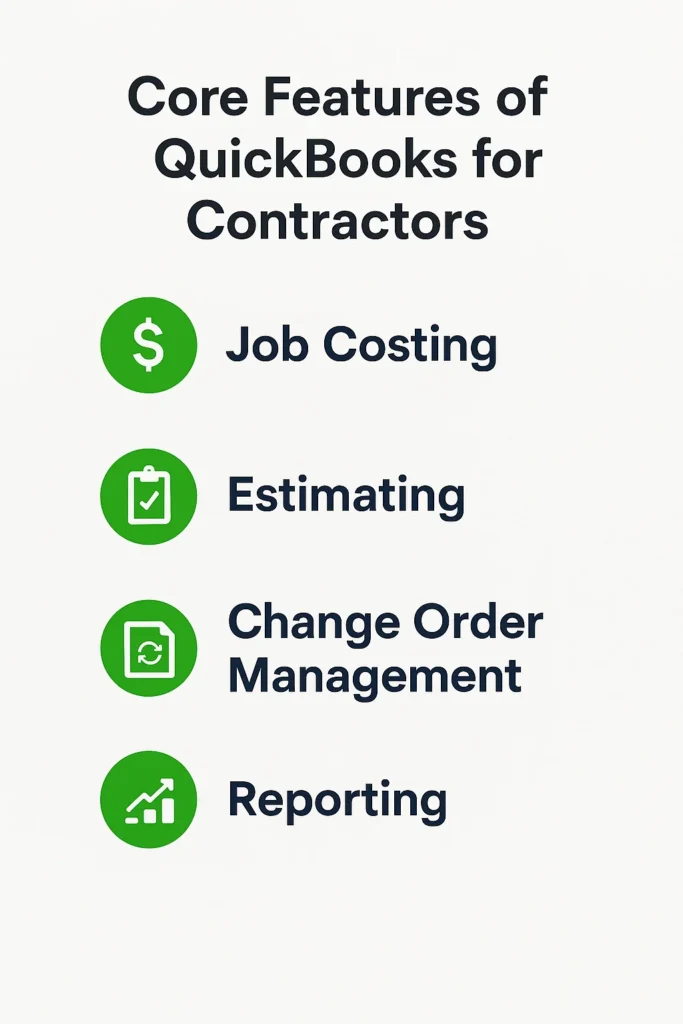

Core Features of QuickBooks for Contractors

Job Costing and Estimating Tools

QuickBooks offers built-in job costing tools that help contractors track costs per project. This feature ensures that each job remains within budget. Explore How to Generate Financial Statements in QuickBooks for a more detailed look.

Payroll Management Tailored to Job Sites

QuickBooks simplifies payroll by allowing contractors to manage payroll directly from job sites, ensuring accurate worker compensation. For more details, check out QuickBooks Self-Employed vs. QuickBooks Online.

Invoicing, Billing, and Payment Processing

QuickBooks automates invoicing and payment processing, reducing administrative time and helping contractors get paid faster.

Industry-Specific Benefits of QuickBooks

Real-Time Financial Visibility

QuickBooks provides real-time financial data, allowing construction companies to track income, expenses, and profits across multiple projects.

Integration with Construction Software

QuickBooks seamlessly integrates with other construction management software, making it easier to track project data. Learn more about QuickBooks for E-commerce Businesses.

Streamlined Subcontractor and Vendor Payments

QuickBooks streamlines subcontractor and vendor payments by allowing direct bill payments and tracking outstanding invoices.

Best QuickBooks Versions for the Construction Industry

QuickBooks Desktop Premier Contractor Edition

The Premier Contractor edition is a comprehensive solution with industry-specific tools for managing projects, including job costing, billing, and reporting.

QuickBooks Online Plus and Advanced

QuickBooks Online Plus and Advanced are cloud-based options ideal for growing construction businesses. They offer flexible features and access from anywhere. For detailed pricing, visit QuickBooks Packages and Pricing.

Add-Ons and Integrations to Maximize Use

QuickBooks integrates with various add-ons like Buildertrend, helping contractors streamline project management and accounting workflows.

UX-Focused Design for On-Site and Office Teams

Mobile Accessibility for Field Workers

QuickBooks offers mobile apps that enable field workers to track expenses, submit invoices, and capture receipts on-site. Explore more about QuickBooks Online Features.

Dashboard Simplicity for Project Managers

Project managers benefit from QuickBooks’ simple dashboard, which provides a comprehensive view of project financials at a glance.

Role-Based Access and User Control

QuickBooks allows businesses to assign user roles, ensuring only authorized individuals can access sensitive financial data.

Enhancing Accuracy and Reducing Risk

Automatic Data Sync and Backup

QuickBooks automatically syncs financial data and backs it up, reducing the risk of data loss and ensuring accuracy in financial reporting.

Error Reduction in Manual Entry

By automating data entry, QuickBooks reduces human error, ensuring that all financial records are accurate.

Tax Compliance and Audit Preparedness

QuickBooks keeps construction companies tax-compliant by tracking deductions and offering audit-ready reports. For more customization, visit How to Customize QuickBooks Reports for Your Business.

Improving Profit Margins with Financial Insights

Project-Level Profitability Reports

QuickBooks generates detailed profitability reports per project, helping contractors identify the most profitable jobs.

Cost Forecasting and Budget Planning

With QuickBooks, contractors can forecast future costs, ensuring accurate budgeting for upcoming projects.

Identifying High-Margin vs. Low-Margin Projects

QuickBooks helps contractors evaluate project margins, ensuring they prioritize high-margin jobs to improve profitability.

Better Decision-Making for Contractors

Real-Time Data for Smarter Project Choices

QuickBooks delivers real-time data, enabling contractors to decide on job prioritization and resource allocation.

Custom Reporting for KPIs and Benchmarks

Contractors can generate custom reports tailored to their business needs, providing insights into key performance indicators (KPIs).

Alerts and Notifications for Budget Overruns

QuickBooks sends automatic alerts when a project is at risk of exceeding the budget, helping contractors take corrective actions.

Scalability and Flexibility

Growing from Small Contractor to Full Construction Firm

QuickBooks is scalable, making it suitable for small contractors and construction firms. The software grows with your business needs.

Multi-User Environment with Scalable Plans

QuickBooks allows multiple users, making it easy for teams to collaborate on projects and securely access data.

Seamless Upgrade Paths and Data Migration

QuickBooks provides seamless upgrade paths as your business expands, ensuring easy data migration between versions.

How QuickBooks Improves Team Collaboration

Centralized Financial Data Hub

QuickBooks is a central hub for all financial data, ensuring team members can access accurate, up-to-date information.

Transparent Communication Between Departments

QuickBooks fosters department collaboration by ensuring that financial data is transparent and accessible.

Linking Schedulers, Purchasers, and Site Supervisors

QuickBooks links key project personnel, enabling better coordination between schedulers, purchasers, and site supervisors.

Comparing QuickBooks with Other Construction Software

Comparing QuickBooks and Sage 100 Contractor for Construction Businesses

QuickBooks is more affordable and easy to use than Sage 100 Contractor, making it ideal for small—to medium-sized construction businesses.

QuickBooks vs. Buildertrend

While Buildertrend is excellent for project management, QuickBooks excels in accounting features, making it a strong option for contractors focused on financials.

Why QuickBooks Stands Out for Cost and Simplicity

QuickBooks is often the best choice for contractors seeking a cost-effective, simple accounting solution that doesn’t sacrifice powerful features.

Real Construction Business Success Stories

Case Study: A General Contractor Scaling with QuickBooks

Learn how a general contractor used QuickBooks to scale their business by improving cash flow and managing multiple projects.

Case Study: Subcontractor Streamlining Payroll

A subcontractor used QuickBooks to streamline payroll management, reducing administrative costs and improving employee satisfaction.

Lessons from Industry Leaders Using QuickBooks

Industry leaders share their experiences with QuickBooks and how it transformed their construction business operations.

SEO and Google Rank Optimization for Construction Firms Using QuickBooks

Tracking Costs = Better SEO ROI Measurement

Construction businesses can optimize their SEO strategies by accurately tracking costs in QuickBooks, leading to better ROI.

How Financial Data Helps with Local Search Performance

QuickBooks data helps construction businesses understand local market trends, aiding in more effective local SEO strategies.

Case Example: Using QuickBooks Insights to Grow Leads

Learn how using QuickBooks insights can help generate more leads by aligning marketing strategies with financial data.

Final Thoughts on Choosing QuickBooks for Your Construction Business

When and Why to Invest

QuickBooks is a must-have tool for contractors looking to streamline operations and enhance financial management. Learn more about How to Enroll.

ROI on Financial Management Software

Investing in QuickBooks offers a high ROI by reducing administrative overhead and improving project profitability.

Step-by-Step Implementation Tips

Check out QuickBooks Complete Training for a detailed guide to implementing QuickBooks effectively.

Conclusion

QuickBooks is the go-to solution for contractors and construction businesses. It simplifies financial management, enhances accuracy, and provides real-time insights, making it easier to manage projects and increase profitability.

FAQs

Yes, QuickBooks offers scalable solutions ideal for large construction businesses, especially with its online and desktop versions.

QuickBooks allows contractors to manage multiple job sites, track costs, and generate reports per project.

QuickBooks provides strong encryption and cloud-based backup to ensure your data is secure.

While QuickBooks is user-friendly, training can help you maximize its features. Consider a 2-day QuickBooks class.

QuickBooks integrates seamlessly with construction-specific software like Buildertrend, Procore, and others.